Facebook Geniuses: Macy's, Sephora, Lancôme and Michael Kors

L2 and Buddy Media recently revealed the results of their second annual Facebook IQ Index®, with Macy's, Sephora, Lancôme, and Michael Kors ranked as "Geniuses".

The Index measures digital aptitude of 100 iconic luxury and prestige brands across Beauty, Fashion, Specialty Retail, and Watches & Jewellery on Facebook, the world's largest social media platform.

The study, authored by Scott Galloway, NYU Professor of Marketing, a team of experts from L2, and Buddy Media, ranks the prestige brands’ Facebook efforts across four criteria: Size & Growth, Engagement, Programming and Integration.

Each brand was scored against more than 350 qualitative and quantitative data points, and assigned a Facebook IQ ranking of Genius, Gifted, Average, Challenged, or Feeble.

The Top 10

The L2 Facebook IQ top 10 remains dominated by retailers and beauty brands that have been deft at facilitating higher rates of engagement via user generated content and local page posts.

1. Macy's

2. Sephora

3. Lancôme / Michael Kors (tied)

5. IWC

6. Smashbox

7. Swarovski

8. United Colors of Benetton

9. El Corte Inglés

10. Estée Lauder / Pandora (tied)

Key Findings

“We’ve seen tremendous growth by prestige brands on Facebook, specifically as they expand globally,”says Jeff Ragovin, Chief Strategy Officer & Co-Founder, Buddy Media, “The more these powerful global brands open up two-way engagement, create localised content, and amplify their efforts with social ads, the more return they will see.”

We've attached some interesting infographics below showing interesting findings from the second annual L2 Facebook IQ Index: Average Likes Per Day, External Integral Timeline Effect, F-commerce Sophistication, Facebook Around the World and Posts Interaction. Other key findings include:

- While community growth is up, engagement across prestige communities has declined, with the average interaction rate or the percentage of the community liking or commenting on brand posts declining almost 50% year-over-year (See Average Likes Per Day Infographic below)

- The move to the Timeline interface in and of itself does not appear to be a growth driver; Prestige brands added 125% more fans in the 50 days prior to the Timeline launch, than they did in the 50 days after the mandatory switch to the new interface (See External Integral Timeline Effect Infographic below)

- More than 20% of prestige brands still do not engage in any two-way conversation and one-third prohibit fan posts on their Facebook walls

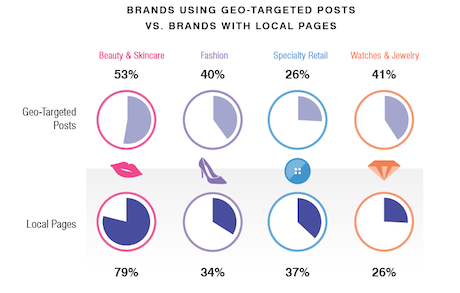

- 41% of brands now maintain at least one local country page; local Facebook pages have grown at double the rate of Global and U.S. prestige communities and register 50% higher engagement (See Posts Interaction Infographic below)

// Watch Video Summarising Key Findings & Insights

All infographics (c) L2

| Attachment | Size |

|---|---|

| Average Likes Per Day | 78.69 KB |

| External Integral Timeline Effect | 80.57 KB |

| F-commerce Sophistication | 47.05 KB |

| Facebook Around the World | 366.33 KB |

| Posts Interaction | 81.06 KB |