Digital Pulse Analysis April-June 2008

Background

Digital Pulse is a confidence index for the digital industry, reflecting the degree of optimism or pessimism that people working in digital media feel about the industry. It is designed to find out how industry professionals are feeling, how they perceive the current digital business climate, salary conditions and their views on what it’ll be like in 6 months time.

Each month, Chinwag polls it’s community, made up of practitioners working across the digital industries, to create a barometer of attitudes and confidence.

The indices for Digital Pulse will be released each month, with a detailed trend analysis undertaken each quarter. This report details the findings of the June survey, as well as an overall view of market sentiment during Q2 2008.

Chinwag is a community media company providing a focal point for digital media practitioners in the UK and beyond: http://www.chinwag.com.

For further information or comments, contact us.

Index

- Background

- Executive Summary

- Index performance over Q2 2008

- Market confidence over the quarter

- Current market conditions

- Future conditions – six months from now

- Intention to remain in place in current role

- Satisfaction with current salary

- Extent to which employers are more likely to

hire people with permanent experience - Current market conditions by salary bracket

- Overall index trends Q2 2008

- Market sentiment by sector

- Conclusions

- Methodology

- About Chinwag

Executive Summary

The Digital Pulse provides a benchmark for confidence across the digital industry.

The index for June 2008 was 123.0 indicating that there is an overall sense of positivity within the market, both in terms of current and future conditions. This is over a baseline of 100, where 100 equates to a neutral response on a sale of 0-200.

Over the quarter sentiment has slipped, with positive sentiment down 2.5 points (or 2%) over April, May and June 2008. While overall sentiment at the end of Q2 was lower than at the end of Q1, June’s Digital Pulse has recovered 1.4% from its position in May 2008. We will have to wait for the next survey to discover whether or not this is the first sign of recovery.

Return to Index | Take the Digital Pulse

The Indices

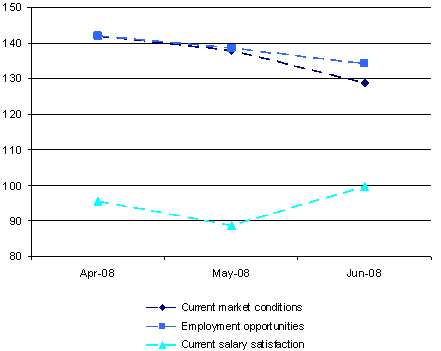

The individual indices that make up the Digital Pulse are:It’s worth noting that only one area shows a negative response – that of satisfaction with current salaries, which dropped over the quarter an overall 2.3 points. However, this is an improvement over April and May, when sentiment dropped below 89 points.

It’s likely that this response reflects a general market concern about pay scales, given the rapid increases in consumer costs (fuel, food, energy, lending, etc.) over the same period.

By summarising these 6 key responses, we are able to provide two further indices which report confidence in the current climate, as well as in six months time.

These are as follows:

(down from 126.6 in April)

(up from 123.9 in April)

While there has been a clear decrease in market confidence about the immediate future, there is growing confidence about the role that the digital industry can play in a constrained economic environment. While overall expenditure may drop, online investment may increase significantly as a means for companies to cut their costs.

Return to Index | Take the Digital Pulse

Index Highlights

- Growing concerns about the wider credit crunch impact sentiment on current market conditions

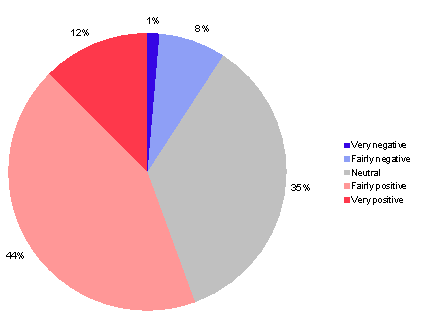

- Growing concerns about the wider credit crunch have impacted on sentiment over the quarter. While 56% of respondents were feeling fairly positive or very positive about the impact that the credit crunch will have on their business, this was a fall since the end of Q1. During Q2 itself, positive sentiment continued to diminish, with a fall in the index of confidence in current market conditions of just over 13 points or 9.4%.

- Confidence in the future remains steady

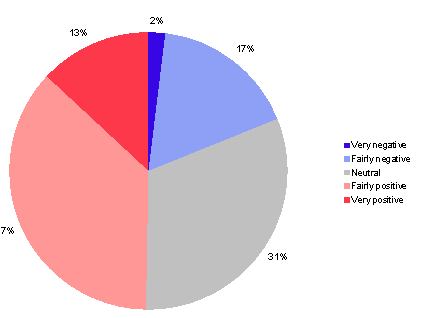

- While 50% of respondents are fairly or very positive about the buoyancy of the digital industry in 6 months time, only 2% of respondents are seriously concerned. The biggest change was the increase in number of those who are neutral about the future – a great deal is likely to be dependent on activity in the wider economy. The index fell by less than 10.7 points (8.8%) between April and June.

- Digital recruitment flying high

- Some 62% of respondents continue to see ample employment opportunities, with 19% of responses being neutral. Only 3% of respondents articulated strong concerns.

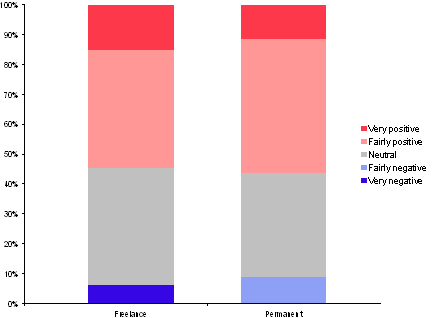

- Permanent staff more confident than freelancers

- Permanent staff and freelance staff were fairly equally matched in terms of positive sentiment. Both freelance and permanent staff reported more than 50% fairly or very positive sentiment about current market conditions. For those who did report negative sentiment, levels of negativity were higher among freelance than permanent employees.

- Recruitment sector boasts highest confidence

- Interestingly, the most positive sector of the market were the recruitment agencies, where 80% of respondents were fairly or very positive about conditions. These were closely followed by advertising and marketing agencies which had a 70.4% positive response to the present climate.

- Online publishing and mobile sectors least confident

- At the end of the last quarter, online publishers were reporting the strongest negative sentiment at 36%. This trend continued over the second quarter, with continuing falls in positive sentiment. The mobile sector also reported a strong drop in positive sentiment overall, despite an initial increase in April to May. This could reflect concerns about business models which rely heavily on advertising spend, or a fear about market recoil from spend on interactive mobile campaigns.

- Industry rife with high salary expectations

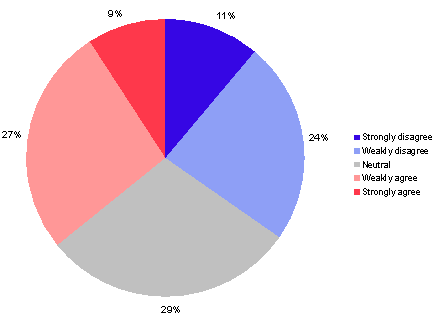

- 62% felt that their salary didn’t reflect their true worth.

Index review for June

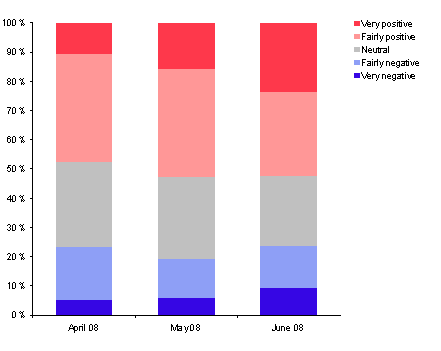

Digital Industry sentiment in June 2008

Return to Index | Take the Digital Pulse

Market conditions in six months

Return to Index | Take the Digital Pulse

Ample employment opportunities

Return to Index | Take the Digital Pulse

Belief that current salary reflects true worth

Return to Index | Take the Digital Pulse

Difference in perception between permanent and freelance staff

Return to Index | Take the Digital Pulse

Index performance over Q2 2008

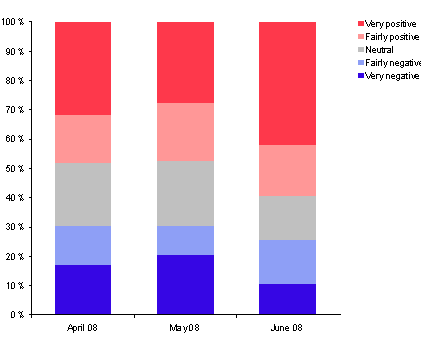

Market confidence over the quarter

While overall confidence has fallen overall since the end of Q1 2008, market perceptions have shown an uptick since May 2008.

Index Responses over Q2 2008

| Variable | April 08 | May 08 | June 08 |

| Current market conditions | 142.1 | 137.8 | 128.8 |

| Market conditions six months from now | 131.6 | 129.3 | 120.9 |

| Employment opportunities | 142.1 | 138.5 | 134.3 |

| Intention to remain in current job | 116.1 | 112.3 | 131.4 |

| Current salary satisfaction | 95.6 | 88.8 | 99.7 |

| Employer preference for permanent experience | 114.9 | 121.7 | 121.6 |

| Confidence in current conditions | 126.6 | 121.7 | 120.9 |

| Confidence in expected conditions | 123.9 | 120.8 | 126.1 |

| Consumer Confidence Index | 125.5 | 121.3 | 123.0 |

Return to Index | Take the Digital Pulse

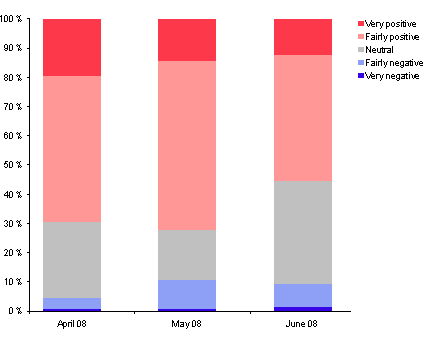

Current market conditions

Over the quarter confidence in current market conditions has shown a fall, down 5.7 points (4.7%). However, the change is greatest in terms of a shift away from very positive perception, and an increase in the amount of neutral feeling.

Return to Index | Take the Digital Pulse

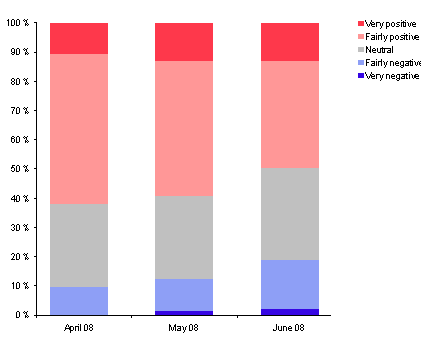

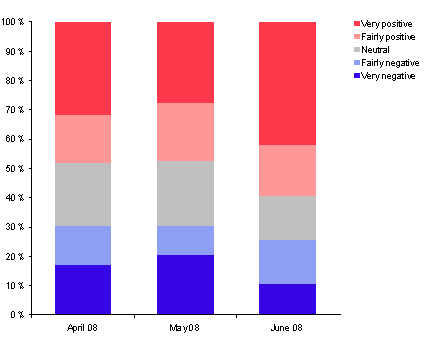

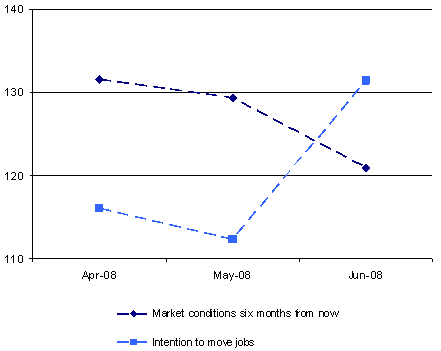

Future conditions - six months from now

Respondents are reporting an overall increased confidence about the next six months, up 2.2 points (1.8%) over the quarter.

Return to Index | Take the Digital Pulse

Intention to remain in place in current role

The highest index score relate to intention to move jobs within the next six months (up 15.3 points or just over 13%).

Satisfaction with current salary

Despite negative feelings about salary satisfaction, June’s figures showed a rebound from May and were also up from April. Over the quarter, this number rose 4.1 points (4.3%).

Return to Index | Take the Digital Pulse

Extent to which employers are more likely to hire people with permanent experience

Belief that employers are showing a preference for permanent experience over freelance rose 6.7 points (5.8%). This supports indications from the Digital Pulse at the end of Q1 2008 that freelancers currently benefiting from the dearth of available talent may experience a tougher time finding permanent roles as the market tightens.

Return to Index | Take the Digital Pulse

Current market conditions by salary bracket

Respondents in the top end of their careers (£90k+) were generally more positive than those in junior salary ranges (<£30k). Responses over the quarter show that those with salaries in the middle range are maintaining a positive or neutral stance on the market. Less than 20% of those in the junior salary range reported concerns which, in a salary bracket most sensitive to market changes, support indications of overall positive market sentiment.

Return to Index | Take the Digital Pulse

Overall index trends Q2 2008

Current market perception

Return to Index | Take the Digital Pulse

Market conditions six months from now

Return to Index | Take the Digital Pulse

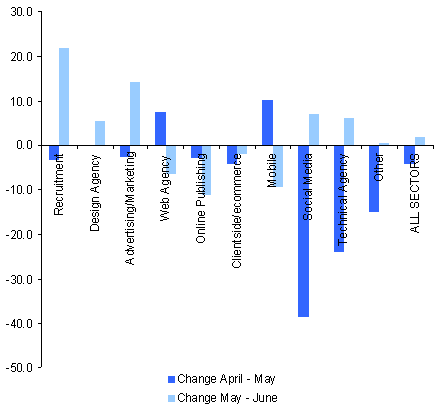

Market sentiment by sector

| Sector | CCI Apr-08 |

CCI May-08 |

CCI Jun-08 |

Change April - May |

Change May - June |

| Recruitment | 118.3 | 115.0 | 137.0 | -3.3 | 22.0 |

| Design Agency | 120.0 | 120.0 | 125.4 | 0.0 | 5.4 |

| Advertising/Marketing | 124.1 | 121.5 | 135.9 | -2.5 | 14.4 |

| Web Agency | 133.2 | 140.6 | 134.1 | 7.4 | -6.5 |

| Online Publishing | 120.7 | 117.7 | 106.5 | -3.0 | -11.2 |

| Clientside/ecommerce | 125.5 | 121.3 | 119.4 | -4.2 | -1.9 |

| Mobile | 107.1 | 117.1 | 107.8 | 10.1 | -9.4 |

| Social Media | 157.5 | 119.0 | 126.0 | -38.5 | 7.0 |

| Technical Agency | 150.0 | 126.0 | 132.0 | -24.0 | 6.0 |

| Other | 130.9 | 115.9 | 116.5 | -15.0 | 0.5 |

| All sectors | 125.5 | 121.3 | 123.3 | -4.2 | 2.0 |

While online publishing remains the sector with the most negative response to market conditions, the mobile sector has reported increasing negativity.

Sentiment was highest in the recruitment market, followed soon after by the advertising and marketing agencies. While web agencies helped contribute to a 77% positivity rating at the end of Q1 2008, overall sentiment in the web agency market fell over Q2. This could in large part be due to tighter market conditions impacting those businesses which focus on advertising as a key source of income.

Changes between April and May reported the strongest negative sentiment but May to June reported strong recovery in sentiment in many sectors.

Return to Index | Take the Digital Pulse

Overall sector trends in sentiment over Q2 2008

Return to Index | Take the Digital Pulse

Conclusions

Confidence in the current market conditions remains positive (index of 123), but has dropped overall during the quarter. This confidence is reflected in continued positive sentiment regarding employment opportunities (although down over the quarter) and a strongly increasing negative attitude towards moving jobs.

While the current economic environment makes it more likely that companies will look to digital channels and services for efficiencies and cost savings in both operations and marketing, the overall environment always has an impact on sentiment.

Those who have been in the industry longer, and are at the top of their professions, are expressing more positive sentiment. This is partly due to an increased understanding of the dynamics of their own businesses but also experience of the ups and downs of activity in what remains, despite its size, a developing market.

The biggest shift over the quarter was sectors expressing great concern. In June the sector expressing most concern was the mobile sector. This could in large part be due to concern about the predominantly consumer-facing nature of services, which is likely to be most affected by broader economic conditions.

Based on responses over the last three months, there are growing concerns regarding current market conditions, with a 5.7 point fall. However, despite a drop of 2.1 points at the beginning of the quarter, confidence about the future seems to be on the increase, with overall sentiment up 2.2 over the quarter.

The next quarterly analysis of the Digital Pulse will cast further light on this topic as the trends in confidence emerge. s

Return to Index | Take the Digital Pulse

Methodology

This short survey was designed to gauge confidence feedback from the people that work in the digital industry. The respondents were self-selecting from the audience across Chinwag’s network of websites and links from high-profile industry blogs.

Details about the survey:

- Response were gathered from 1st April to 30th June 2008

- Data and analysis obtained from 463 responses altogether

- All surveys were completed anonymously

Return to Index | Take the Digital Pulse

About Chinwag

The Chinwag community is a focal point for digital media practitioners in the UK and beyond. Founded in 1996, Chinwag has developed into a community media company that publishes websites, discussion forums and runs events supporting the people and companies who work in the digital industry.

Chinwag publishes Chinwag Jobs (http://jobs.chinwag.com), the leading recruitment website for Online Marketing, Digital Media, Web, Design and Technical positions. British Sky Broadcasting, Google, Yahoo, Vodafone, Yell and the majority of recruitment agencies who place staff in the sector use the service.

Chinwag Live is the company’s event series founded to cast light on trends in the digital media and marketing industry covering topics such as social media measurement, web TV, mobile advertising, online PR and many more. These sessions have sold out throughout 2008 and gained a strong reputation for debate and knowledge sharing.

Chinwag’s community is focused around its live events, networking, blogs and email forums. The first forum, an email discussion list called uk-netmarketing, is acknowledged as a key destination for industry professionals. Chinwag’s community has now grown to cover other topics including design, usability, social media and wireless marketing, generating more than one million emails every month.

Chinwag also runs Viralmonitor (http://www.viralmonitor.com), which is used to promote viral marketing campaigns. Featured brands include Make Poverty History, Visit London, Sky Sports, Swiftcover.com, Cartoon Network, BBC Five Live, Bacardi, GMTV and the RSPCA

For more information see: http://www.chinwag.com/about