Twitter's Quarterly Results: What Marketers Really Need To Know

There’s been a lot of negative coverage this morning regarding Twitter’s latest financial results. The focus has been on the poor profit figures (the company posted a net loss for the full year of $645 million against revenues of $665 million), but what numbers did the social network reveal that might be of interest to those brands using it to engage consumers and customers?

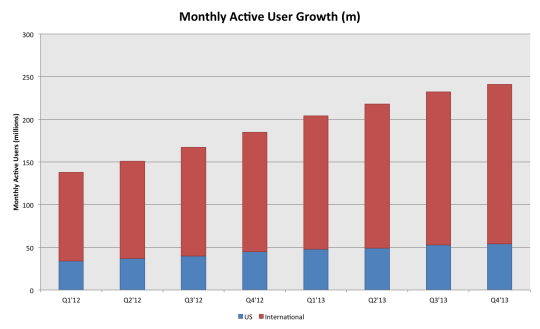

Usage

Investors have reacted badly to the news that – in the US – monthly active users (MAUs) only grew by one million (1.9%) in the last quarter of 2013.

What marketers need to know:

MAUs outside the US grew by 8 million in Q4 2013, an increase of 4.5% over the previous quarter

Year-on-year growth in the US was 20%, bringing the number of monthly active users to 54 million

Outside the US, MAUs grew year-on-year by over a third – up to 187 million from 140 million in Q4 2012

CONCLUSION: The usage numbers in the US might be stalling but growth outside the US shows no sign of letting up

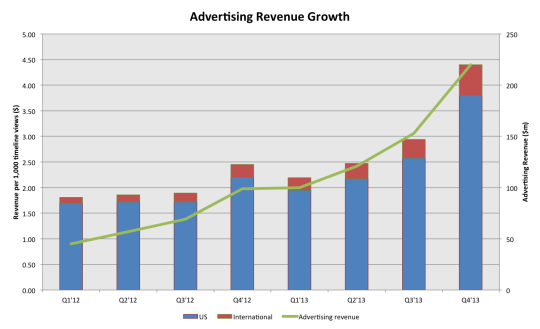

Advertising

Although profits are down Twitter’s full year revenue is up $665, an increase of 110% year-on-year.

What marketers need to know:

Around 90% of Twitter’s revenues come from advertising, and these rose by $67m (over 40%) in the last quarter of 2013 alone

Full year advertising revenues increased by 120% to $594m from (just) $270m in 2012

Average advertising revenue earned per 1,000 timeline views (how Twitter measures user engagement) stood at $3.80 in the US and just $0.60 outside the US in Q4 2013 – but the latter rose by 140% year-on-year

CONCLUSION: Twitter is still a ripe advertising channel and marketers outside the US should start familiarising themselves with its products and services

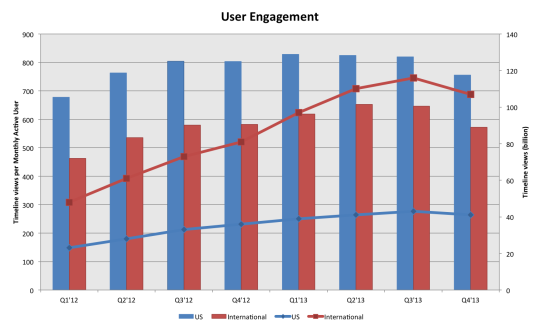

Engagement

This area, I suspect, is the one most troubling Twitter and its investors. It should also be a cause for concern to marketers.

What marketers need to know:

The absolute number of timeline views decreased across the board in Q4 2013, down by 11 billion to 148 billion worldwide, although still up from the same quarter in the previous year

Worse still given the growth in monthly active users, the number of timeline views each user makes dropped by 10% worldwide from Q3–Q4 2013 (a bigger slump internationally than in the US), with an average user making 613 timeline views over the quarter compared to 635 the previous year

Whichever way you look at the data, user engagement is down: quarter-on-quarter; year-on-year; full year-on-full year; and both in the US and internationally

CONCLUSION: If user engagement continues to fall, marketers will need to work even harder to reach and engage consumers and customers that are themselves interacting less

You can download a PDF of Twitter’s earnings presentation from their website.

Original blog post by Niall Cook.

Photo (cc) Mkhmarketing. Some rights reserved.